“In the dust choked markets on the outskirts of Kenya’s capital, the most valuable tool Wangari owns is not her plow or her scales. It is a battered smartphone with a cracked screen.

For years, Wangari lived at the mercy of the cash lag. She waited days for buyers to arrive with physical notes. She lived in fear of the thieves who stalked the payday trails. She watched her children go hungry while her earnings sat locked in the pockets of distant middlemen. To the ivory towered banks in the city centre, Wangari was invisible, a high risk-ghost without a paper trail.

This is not about fintech or disruption. It is about the fact that the device already in her hand, that battered phone, has finally given her the one thing the world’s banks never could: financial services, payments and freedom.”

Jean Pierre Mugenga published in ‘When poverty meets Innovation’ Jan 26th 2026

Mobile Network Operators (MNO) Safaricom, MTN, Orange and Vodacom have changed life positively for low and lower-middle income households with mobile money. M-PESA and MoMo enable digital payments and receipts, micro loans, micro insurance, micro contracting all from their smartphones. I applaud that innovation but there is a danger for MNOs which have taken up to a decade to gain their current market positions.

Mobile Virtual Network Operators (MVNO) are in a strong position to disrupt them

This article, based on extensive research by Mike McLaren, posits that the first mover advantage gained by Mobile Network Operators in Africa is under serious threat from a new breed of Mobile Virtual Netwrk Operators providing digital payment and financial services to subscribers without access to bank accounts. A $150BN opportunity.

Contents

- Competitive advantages of the MVNO

- The MNO complexity problem

- The MVNO sweet spot

- MNOs have proven the market

- MVNOs have their own success

- Global expansion: the next wave

- The prize: a $150BN opportunity

Introduction

In Sub-Saharan Africa MNOs (Mobile Network Operators) Safaricom, MTN and Vodacom have deployed impressive mobile money solutions for people of all income levels to both pay digitally, receive payments and enjoy integrated financial services. M-Pesa from Safaricom and MoMo from MTN show how these MNOs have leapfrogged banks to provide all peoples to manage life and business as consumers and businesses. All from their smartphones. Magic that works.

What I had not fully realised is how long it has taken to achieve this- around a decade in fact. Legacy technology, varied government compliance and support, and scarce resources are some of the reasons.

Mike McLaren, an investor, entrepreneur with immense experience of banking and telecoms, poses a challenge to these existing MNOs , Payment Rails Operators, Fintechs from the advance of Mobile Virtual Network Operators (MVNOs).

- Competitive advantages of the MVNO.

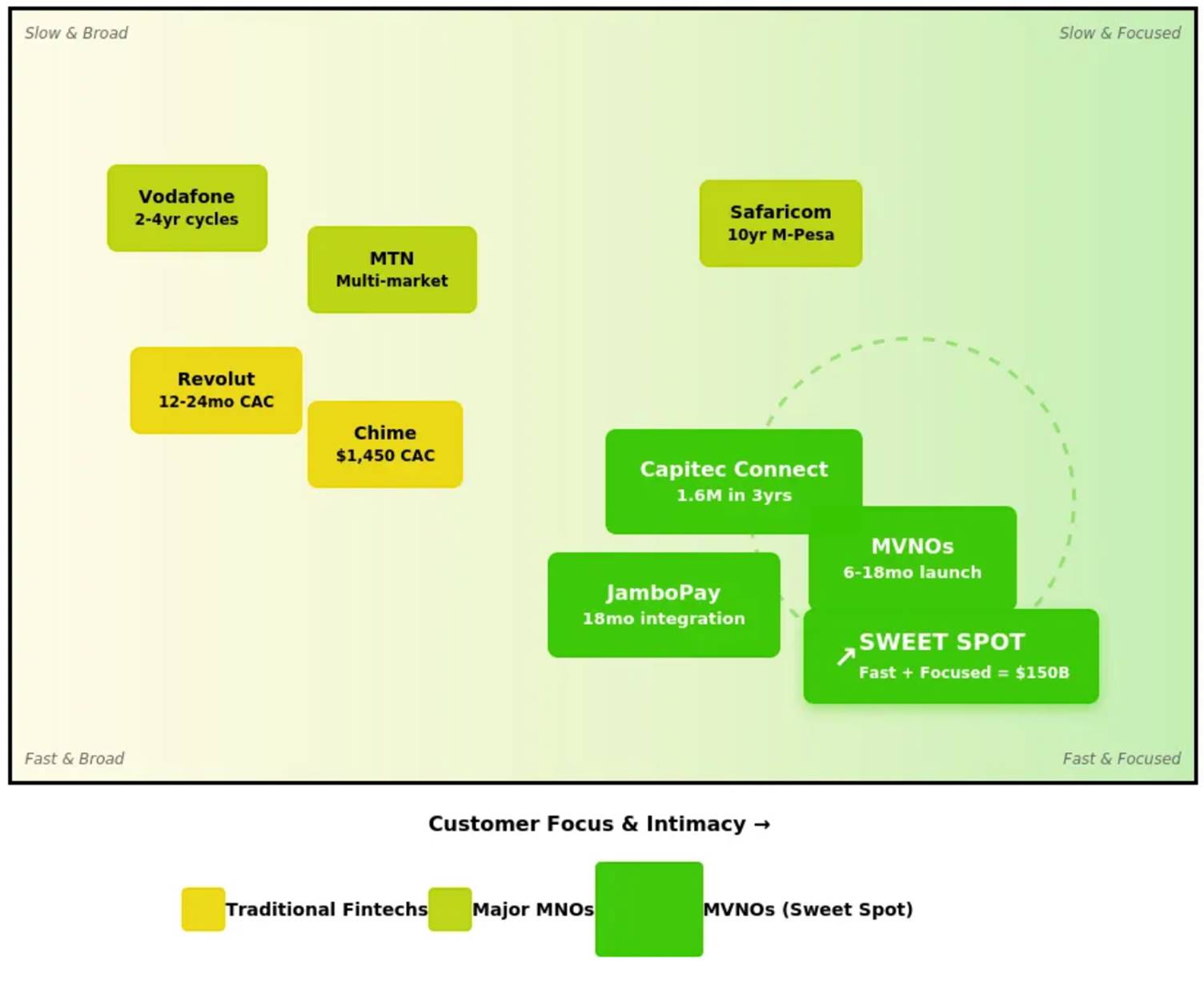

“MVNOs possess structural advantages that The prize- a $150BN opportunity neither traditional Fintechs nor major MNOs can easily replicate — hyper-focused customer segments, rapid innovation cycles, existing billing relationships, and the regulatory nimbleness to launch financial services in 6–18 months rather than the 2–4 years required by infrastructure-heavy MNOs.”

To emphasise that he highlights three innovative and disruptive Fintechs which recognise and will strategically leverage the MVNO model. .

"Between April and August 2025, Revolut, N26, Klarna, and Monzo — collectively serving over 100 million customers — launched or announced the launch of Mobile Virtual Network Operators (MVNOs) services. These weren’t coordinated moves but rather represent independent recognition by the world’s most sophisticated Fintechs that traditional growth economics have failed, and that MVNOs offer a sustainable path forward. The concentration of launches within five months signals a complete market inflection. The 18–24-month window for first-mover advantage is already narrowing."

In Africa the incumbent gorillas in the market may have the look of complacency having established substantial revenues for customers without access to banks albeit in a small number of countries.

- The MNO Complexity Problem

Major MNOs like Verizon, Deutsche Telekom, MTN, Safaricom and Vodacom are infrastructure giants serving hundreds of millions of customers across diverse segments. This scale creates inherent barriers to financial services innovation:

- Infrastructure Complexity-mixed legacy and new apps

- Innovation Speed slow- a decade to deploy current mobile money

- Customer Dilution: Value propositions spread across suburban families and urban professionals already using multiple fintech apps.

- Resource Allocation: Prioritization of infrastructure investments over customer experience innovation.

Even Safaricom’s M-Pesa's attempts to replicate it in other markets have largely failed due to different regulatory environments and customer behaviours.

The Fintech Customer Acquisition Problem

Traditional Fintechs face a CAC crisis with an industry average of $1,450 per customer in 2025, and enterprise clients reaching $14,772 . Compounding this challenge, global fintech funding in H1 2025 fell to just $44.7 billion — the lowest since 2020 — while mobile ad spend is projected to hit $540 billion in 2025, turning user acquisition into an unsustainable bidding war. Fintechs struggle to achieve the daily engagement necessary for platform economics while burning through capital at unprecedented rates.

Fintechs lack: -

- Existing Customer Relationships and must build trust from zero.

- Billing Infrastructure and accordingly require expensive payment processing partnerships.

- Regulatory Relationships and thus face lengthy approval processes in each market.

- They need costly KYC/AML compliance systems.

- The MVNO sweet spot

MVNOs occupy the strategic middle ground with unique advantages:

- Customer Focus: Lycamobile targets immigrant communities across 23 countries with deep cultural understanding. Mint Mobile serves tech-savvy millennials expecting digital-first experiences. Boost Mobile focuses on prepaid customers

- Technical Infrastructure: Every SIM card contains a secure element — a tamper-resistant chip designed to store sensitive information and process payments offline with bank-grade security. When an MVNO wants to add financial services, they’re updating systems for focused customer bases with unified requirements rather than coordinating across diverse infrastructure and regulatory environments.

- The Innovation Speed Differential: MVNO fintech integrations are estimated at 6–18 months from concept to launch. Compared with MNO fintech integration s — which are estimated at 2–4 years due to infrastructure complexity and regulatory coordination — and Fintech customer acquisition — which is estimated at between 12–24 months to achieve sustainable unit economics — the innovation speed differential and advantages of MVNOs is apparent.

- MNOs have proven the opportunity

Understanding these successes provides the foundation for why focused MVNOs are positioned to capture the next wave of growth in underserved markets.

M-Pesa: The $1 Billion Market Validation

Kenya’s M-Pesa represents the definitive proof that mobile-financial integration creates massive value, generating over $1 billion annually — 42.4% of Safaricom’s service revenue — through a comprehensive financial platform processing over 33 billion transactions annually with 34 million active users (TechAfrica News, 2024; ITWeb Africa, 2025).

MTN Mobile Money: Continental Scale that Took 10 Years

MTN’s mobile money platform, MoMo, reached approximately 66 million active users by Q2, 2024, exemplifying telecom-based financial services achieving massive scale across more than 16 African markets and processing billions in transaction value annually.

The MVNO Opportunity: Proven Markets and Agile Execution

If Safaricom generates $1 billion annually from financial services and MTN processes billions in transaction value, the demand for mobile-financial integration is unquestionable. The market exists, customers engage daily, and revenue scales significantly. But these successes required decade-long development cycles, massive infrastructure investments, and regulatory coordination across multiple markets. MVNOs can now leverage this proven market demand while executing with the agility, focus, and speed that infrastructure giants cannot match.

Major MNOs necessarily focus on mass markets and regulatory compliance across diverse segments. The more than 400 million MVNO subscribers globally represent precisely the underbanked, informal economy, and diaspora communities that need comprehensive financial services, but whom infrastructure giants serve as secondary priorities.

The question is whether focused, agile operators can now execute similar strategies faster, cheaper, and in markets that infrastructure giants find unprofitable to serve directly.

- African MVNO Success Stories

Capitec Connect

When South African challenger bank Capitec launched their MVNO in 2021, they weren’t launching a mobile service — they were completing a customer platform creating unsustainable competitive pressure on traditional operators.

The execution delivered extraordinary results: 1.6 million subscribers by 2024, representing the fastest MVNO growth in African history. Capitec demonstrated significantly higher cross-sell rates to banking products compared to traditional MVNO offerings, with substantially higher revenue per integrated customer due to comprehensive financial service usage. The integrated platform creates customer lifetime values meaningfully above standalone banking or telecom offerings.

Capitec achieved these results with CAC significantly below both fintech industry averages and traditional MVNO acquisition costs.

JamboPay: A Pure MVNO Play

JamboPay’s unique market position as both a leading fintech provider and licensed MVNO in Kenya demonstrates convergence viability from the MVNO perspective. According to company reported figures, with 1.2 million customers across their integrated platform, the company proves that focused operators can successfully compete with both banks and major telecoms.

Unlike Safaricom’s decade-long M-Pesa development process, JamboPay achieved integration within 18 months by leveraging existing fintech expertise and MVNO agility. The company’s CEO noted that traditional MVNOs are “leaving at least 42% of revenue on the table” by not integrating financial services.

Rain’s Platform Evolution

Rain’s transformation from data-focused operator to South Africa’s fourth major mobile network demonstrates platform-first thinking enabling rapid service expansion that larger operators struggle to match.

Rain began building its network in 2016 with cloud-native, standalone infrastructure designed for service integration. The company’s platform approach allowed evolution to full mobile services through its Rainone integrated platform launched in May 2023 — a development cycle that would have taken major MNOs 3–5 years.

MVNO-Fintech Convergence

The MVNO-fintech convergence thesis is validated through multiple independent market signals and proven business models that traditional investment analysis often overlooks.

Regulatory Momentum

African regulatory frameworks increasingly support MVNO-fintech integration, with significant developments through 2024–2025. Kenya’s Central Bank actively promotes mobile money innovation, while South Africa’s regulatory sandboxes encourage financial services experimentation. Nigeria achieved a regulatory breakthrough in July 2024 when the Nigerian Communications Commission issued 46 MVNO/MVNA licenses to liberalize the telecom market and bring connectivity to underserved regions.

Technology Infrastructure Readiness

Critical technical barriers that historically prevented seamless integration have been eliminated. Secure element technology in SIM cards now provides bank-grade security for financial transactions. Cloud-native platforms enable rapid service deployment. Open APIs allow MVNOs to integrate financial services as easily as launching data plans. The technology foundation for convergence is mature and battle-tested.

The success factors enabling African MVNO-fintech convergence — mobile-first customer bases, underbanked populations, essential service relationships — exist globally. Latin America, Asia Pacific, and even developed markets contain similar customer segments that traditional banking underserves but MVNOs actively serve.

- Global Expansion: The Next Wave

The structural advantages enabling African success now apply globally as fintech costs become unsustainable and market conditions favour integrated platforms over standalone applications.

Geographic Opportunity Analysis

- Sub-Saharan Africa: Established success with 400 million unbanked adults carrying mobile phones and proven regulatory frameworks.

- Asia Pacific: 2.1 billion mobile subscribers with 60% underbanked population across fragmented telecom markets.

- Latin America: Sophisticated payment infrastructure combined with substantial diaspora communities and remittance flows.

The Critical Competitive Dynamic Between MNOs and MVNO

The most significant competitive threat comes from traditional MNOs recognizing the opportunity and attempting to replicate MVNO-fintech strategies. However, their scale and complexity create classic innovator’s dilemma scenarios that favour smaller, focused operators. MVNOs probably have 18 to 24 months to win this market before the incumbent MNOs close the gap. Time to move and fast!

- The prize? - a $150bn opportunity

The Q2 and Q3, 2025 launches by Revolut, N26, Klarna, and Monzo demonstrate that the world’s most sophisticated operators recognize MVNOs hugely sustainable fintech distribution model. The next 18–24 months will determine who captures this $150 billion opportunity — and who watches from the sidelines.

McLaren provides extensive financial analyses to explain the huge potential so please follow the link below to his well-researched article.

Links to relevant articles

Why MVNOs Will Win the Next Fintech Revolution Mike McLaren in Medium

When Poverty Meets Innovation: Five Technologies Rewriting the Rules of Survival by Jean Pierre Mugenga

Telcos are becoming banks for the next 2 billion customers by Douglas Laney in Forbes Mag

Remember the future: The next frontier for African telcos McKinsey

Between April and August 2025, Revolut, N26, Klarna, and Monzo — collectively serving over 100 million customers — launched or announced the launch of Mobile Virtual Network Operators (MVNOs) services. These weren’t coordinated moves, but rather represent independent recognition by the world’s most sophisticated fintechs that traditional growth economics have failed, and that MVNOs offer a sustainable path forward. The concentration of launches within five months signals a complete market inflection. The 18–24 month window for first-mover advantage is already narrowing.

unknownx500

unknownx500