Siemens, a German industrial giant (whose chief executive, Roland Busch, is pictured), has been using AI ( the whole field) at its futuristic factory in Erlangen, in Bavaria, for many years. More than 100 algorithms are improving production at the site.

French enterprise Schneider Electric has around 100 applications of the technology already in operation. Morgan Stanley, an investment bank, reckons that these will result in around €400m ($470m) in annual savings for the company this year. That amounts to less than 1.5% of its total costs. Mr Weckesser , who oversees the digital implementations of this French manufacturer of industrial equipment, has his sights set much higher. Eventually, he declares, “there will be not a single product or function at Schneider Electric that will not be affected by artificial intelligence.”

Europe’s manufacturers are well ahead of their peers across the Atlantic. A EIB’study found that 48% of them use AI, including older types of machine learning and “big data”, whereas only 28% of American manufacturers do. AI is a field in which there are many tools and not just the flashy new toys of GenAI and AgenticAI.

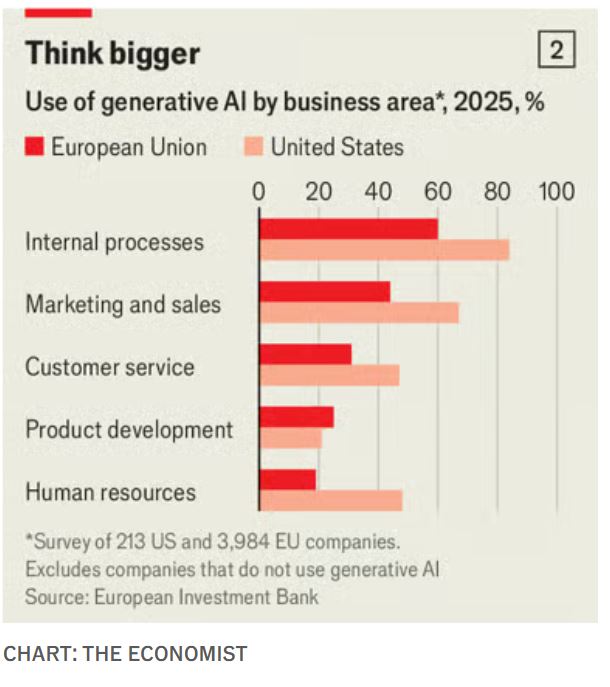

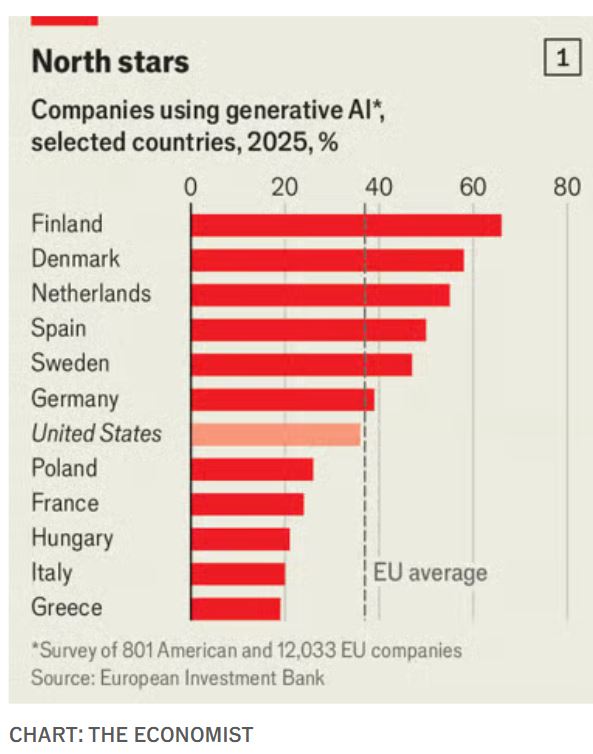

European manufacturers also focus on a narrower application of AI compared with US ones. Only 55% of EU firms surveyed by the EIB that were using AI were doing so in at least two areas of their business, compared with 81% of American ones. Does this focus lead to greater success operationalising and scaling AI?

A growing number of European companies are likewise now embracing AI. A recent survey by the European Investment Bank (EIB), a multilateral financial institution, showed that around 37% of EU firms use the generative sort, compared with 36% of American ones.

Europe may lag behind the USA (and China) on building AI models- just three of them in 2024, compared with China’s 15 and America’s 40. And it has no hyperscalers of its own to pour vast sums into building data centres. But when it comes to widespread productivity gains, adopting and successfully deploying AI will matter more than selling it.

The practice of the EU's regulators to regulate and err on caution with AI may limit progress as may the economic sluggishness of the large EU economies. The UK, on the other hand, seems like it will have a more progressive regulatory approach and the field of AI is a priority area for government investment and encouragement. Deepmind was a British company before being acquired by Alphabet. The UK, the EIB surveys only covered EU countries)

The UK government's own survey (Department for Science, Innovation & Technology (DSIT) - "AI Adoption in the UK" (2024)) found that approximately 22% of all UK businesses had adopted any form of AI (which includes generative, robotic process automation, machine learning, etc.) as of early 2024. The report highlighted that adoption is heavily skewed towards larger firms. The UK has a larger proportion of SMEs than EU countries. SMEs tend to adopt new technology slower than large enterprises. That will change though in 2026 as they see the benefits and learn from the mistakesof early adopters. Crucially, the survey noted that generative AI is the fastest-growing type of AI being adopted.

The UK also has a larger service industry than Europe and here the picture is rosier.

EY's survey of 1,200 financial institutions globally found that UK financial services firms are the world's most active adopters of generative AI.

Key Stat: 92% of UK financial services firms have either implemented, are piloting, or are planning generative AI initiatives. This was a higher percentage than any other major market surveyed, including the US.

Deployment Depth: Crucially, 48% of UK firms reported they had already implemented at least one generative AI use case into production (not just a pilot). This was the highest implementation rate globally and double the rate of US firms (24%) at the time of the survey.

McKinsey's 2023/2024 global survey Professional Services" sector (which includes legal, consulting, and financial services) stated that the UK is the top adopter of generative AI across all industries globally.

The UK's financial services sector is arguably the world's most aggressive and advanced adopter of generative AI, particularly in moving from pilot to production. This sectoral strength is a critical part of the UK's strategy to maintain its global financial dominance.

Anecdotal evidence from innovators suggests that UK enterprises are focussed on use cases that match the current capabilities of Generative AI and Digital workers. High volume, highly repetitive, predictable and well understood processes - the boring and mundane admin that takes up too much of human workers' time. AI to automate and augment humans ( deployed effectively) will yield high returns.

Reading about Schneider Electric and Siemens above they appear to have taken the same approach. The SAP custome base must be a tempting target for the adoption of AI as its core systems hold vast amounts of unstructured and valuable data. Applying Generative AI for the boring and mundane could yield high returns. Are SAP's business partners up to the challenge?

There are plenty of challenges of course. Companies struggling for growth may be tempted to cut back their investments in AI to maintain profits in the short term. SAP customers have invested heavily in upgrades and some report of deployment fatique. To stay competitive in the long term, though, SAP customers and others must do the opposite. when it comes to widespread productivity gains, adopting AI will matter more than selling it.

Change is not just about technology as company culture, change management capacity, training and resourcing and ability to brief and get buy-in from all those involved in planned transformation.

Gen apps deployed across many insurers between 1980 and 2000 are still at the core of many- espacially in the Life Insurance, Annuities & Pensions and Reinsurance sectors.

25-30% of UK life insurers still have GEN at core (down from 60% in 2010)

40-50% of US life insurers still dependent on GEN systems

Expected timeline for significant presence: Through 2030s

Complete elimination unlikely before 2040 for most complex cases

Gen apps are still found acoss: -

Policy Administration Systems (Life, Annuity, P&C)

Claims Processing Systems

Billing and Commission Systems

Underwriting and New Business Systems

Reinsurance Administration

Customer Information Systems

A dwindling number of experts and legacy tech practises make it harder year by year to tackle this time bomb ticking aay into the next decade. The UK seems to be ahead of the US in tackling the transformation to modern architectures which is another factor make AI deployment faster.

Legacy systems chain the ability of central IT to operationalise and scale new technologies. And the technology is just one aspect. Change management, training and resourcing staff, contracting collaborative tech partners, the planning and organisation process cost multiple times the cost of AI. And AI is not an island unto itself. Take all the other tech that has to be transformed!

The hype of the large LLM vendors hits the buffers of practical reality whilst the positive aspect of this narrative being Europe on the front foot.

Is it that European enterprises are better than US ones in operationalising and scaling AI? Is it that their ambitions are more focussed and narrow AI deployments yield better results than broad AI? All questions that deserve answers.

Already Europeans as individuals are among the most enthusiastic adopters of generative ai. According to research from Microsoft, a software giant, 32% of them use the technology, based on a population-weighted average of European countries, compared with 28% of Americans and 16% of Chinese. Many Europeans are hopeful about its promise. Pew, a pollster, asked people whether they were more excited or concerned about ai. Americans topped the list of worriers; Europeans were more upbeat (though not as positive as the Chinese, according to other surveys).

https://www.economist.com/business/2026/01/22/europe-can-still-win-the-other-ai-race

unknownx500

unknownx500