“In the velvet darkness of a rural Kenyan village, a mother named Fatuma once rocked her feverish child to sleep by the dim, smoky glow of a kerosene lamp. The acrid fumes stung their eyes. The fuel devoured her earnings. And after sunset, homework was a luxury her children could rarely afford. Nights were for survival, not dreams.

Then came a small solar panel, a Sun King system paid for in tiny mobile instalments. One switch, one moment, and her mud walled home erupted in clean, bright LED light. Her children studied late into the evening, their grades rising like dawn. Fatuma began charging neighbours’ phones for a few shillings, turning darkness into income.

"Now my home is alive at night," she says, her eyes shining brighter than the bulbs. "My children see a future."”

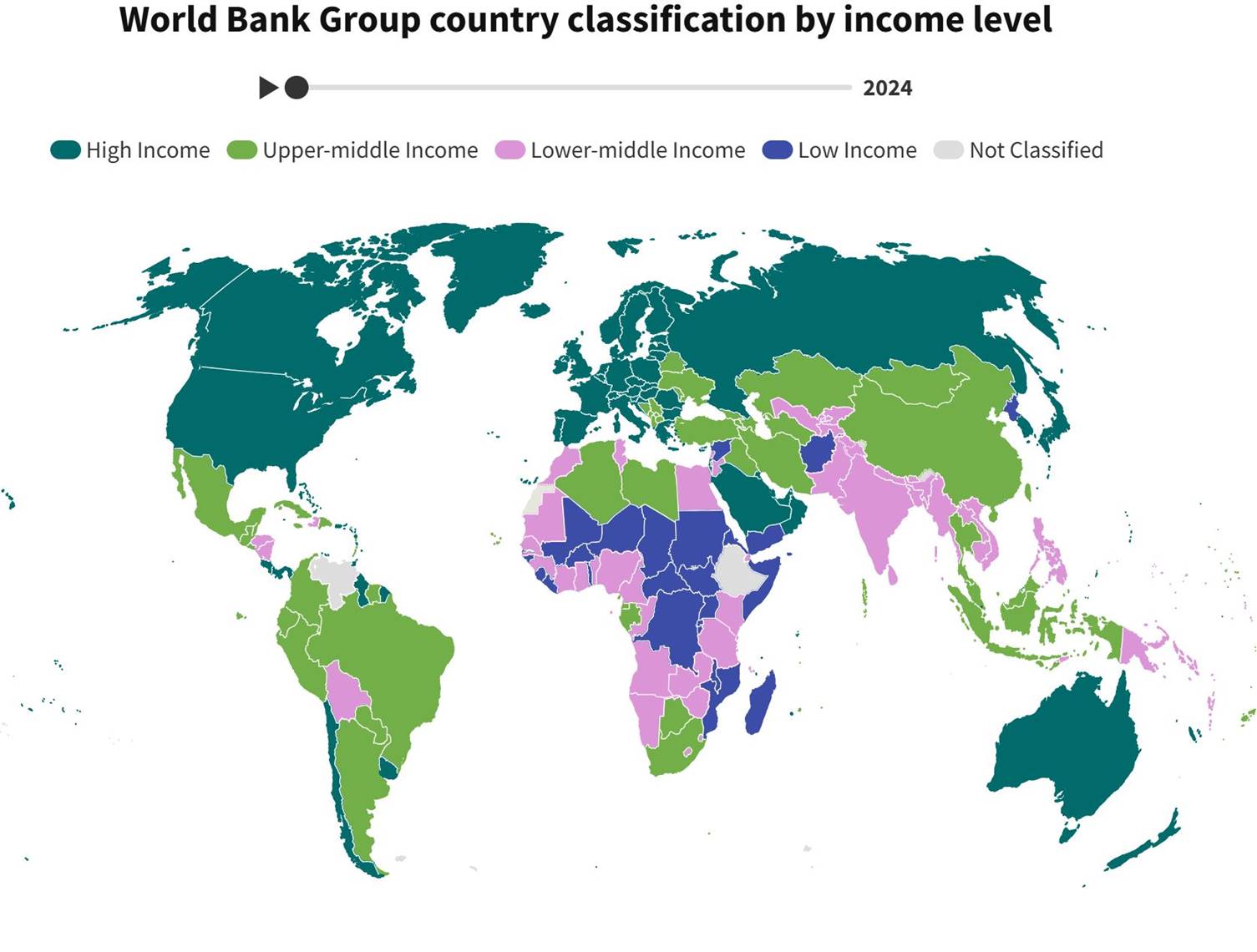

Quotes from Jean Pierre Mugenga who recently posted an article on how five technologies are changing lives for peoples in the lower, lower-middle and upper middle categories.

Five technologies

- Internet without wires - Starlink

- Light in the darkness-power without grids-Sun King

- Wings Over Impassable Roads: Deliveries That Save Lives- Zipline

- Digital Wallets, Global Reach: Finance Without Banks- ReLeaf

- Eyes in the Machine: Diagnosis Without Doctors- AI diagnostics

Mugenga writes:

“Five technologies. One shared genius: they leap over broken systems rather than waiting for them to be fixed.

No corrupt contractor needs to lay a cable. No government must pave a road. No bank must approve an account. No specialist must be physically present.

Innovation arrives directly, affordably and at scale.

The results are profound: children educated, mothers surviving childbirth, entrepreneurs thriving, diseases caught early and communities connected to the world’.

Hundreds of millions have already felt the impact and billions more can in the future”.

Just see the next chart.

This is technology for inclusivity, for humanity and for raising income levels.

African Economic indicators improving

South Africa’s macroeconomic indicators are improving. In 2025 the country recorded consecutive fiscal surpluses for the first time in 15 years. The ratio of debt to GDP could soon start to fall. Average inflation in 2025 was at its lowest level for 21 years. In November S&P, a credit-rating agency, upgraded South Africa’s sovereign debt for the first time in nearly 20 years.

State-run monopolies are being opened up. For 100 years Eskom monopolised the generation, transmission and distribution of electricity. But since 2023 generating plants of any size can be built without a licence. A new independent transmission company means that electricity will soon be traded on an open market. These changes have caused an investment boom.

Transnet, a nationalised firm whose mismanagement of ports and freight rail has crimped exports, is on a similar track.

Spectrum auctions have helped to improve mobile coverage and reduce data costs.

Thw Public Service Amendment Bill should professionalise a civil service stuffed with ANC cadres. It could be “the most crucial institutional reform enacted in our lifetimes”, says Mr Enthoven.

Politically, the Government of National Unity (GNU) has given more stability and

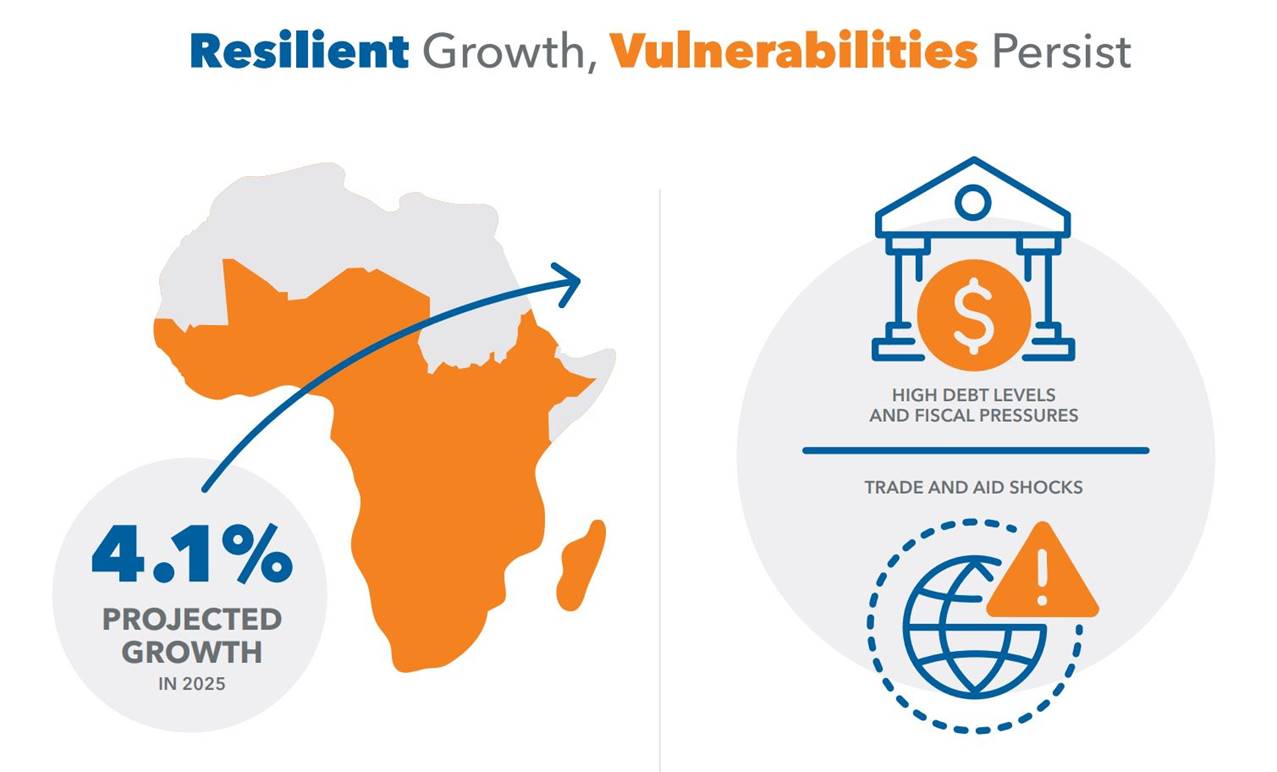

SSA growth looks resilient though there are risks.

Source IMF Oct 2025

impetus to reforms. Whilst new elections in 2027 might endanger the GNU continued pressure from reformers

In Nigeria, the annual inflation rate, which hit a nearly 30-year high of 34.8% in December 2024, fell to 15.2% in December 2025. Growth is returning. The IMF expects the economy to expand by 4.4% in 2026. Following two steep devaluations in 2023, the naira has stabilised. The central bank’s foreign-exchange reserves have risen to $46bn, their highest level in seven years.

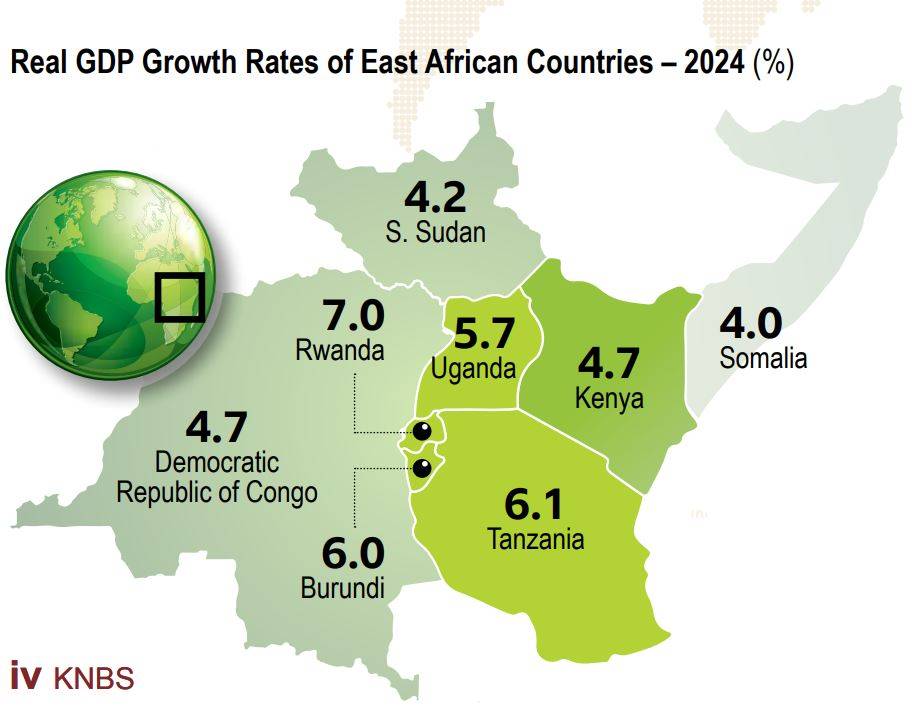

Kenya had a 4.7% increase in GDP in 2024; in fact, the whole of East Africa looks positive. The East African Countries achieved a 5.4% increase in GDP whilst all of Sub-Saharan Africa enjoyed a GDP increase of 3.4%.

Source Kenya National Bureau Statistic 2025

Africa may have many low- and middle-income people but growth, innovation and government reforms can fuse together to help people earn higher incomes.

ReLeaf Financial is determined to play its part in this evolution. It’s patented Proof of Intent platform levarages the potential compute power of smartphones and when integrated into a telco’s back office opens up new revenue opportunties for customers and the telco. Imagine the loyalty value of adding $5 a day to someone who only earns $20 a day!

And the beauty is that being integrated into the systems of the telco and using the same security and compliance the telco has implemented means that the subscriber who trusts their telco will trust this new benefit. They do not have to learn anything new, just behave as normal.

The ReLeaf Platform

US Patent 12,505,416 B2, invented by Christopher Walter Surdak and assigned to ReLeaf Financial Inc. heralds a significant new business model for business and consumers. The system employs a "Proof-of-Intent" consensus mechanism, leveraging notaries and witnesses for efficient transaction validation. Drawing from Surdak's expertise in infonomics and ecosystem economics—where idle resources like data and compute are treated as monetizable assets—the ecosystem creates value through distributed participation, low-cost operations, and incentives aligned with emerging market needs.

This patent embodies his ecosystem economics by monetising idle smartphone compute and energy, turning these into revenue streams for users, telcos, and the network.

This creates a virtuous loop: users provide compute, telcos gain loyalty tools, and the network achieves decentralization. Surdak's infonomics influence is evident in treating "stranded assets" like idle CPU cycles and pre-paid phone energy as free inputs. Witnesses and notaries earn fees from transactions—split proportionally—without requiring upfront staking or heavy computation.

At scale, this yields ecosystem-wide savings that are shared with all participants. Low marginal costs enable micro-transactions, not just payments but with other ecosystem partners micro-contracting in fintech, insurance, supply chains, and remittances.

In regions like Latin America and Africa—targeted by ReLeaf pilots—telcos have started to evolve into hybrid financial providers. Africa leads the way and Latin America is following. With billions of consumers and small businesspeople unbanked and phone-equipped, the system bridges connectivity and finance, aligning with Surdak's view of crypto disrupting centralized institutions. It fosters inclusion by enabling low-effort participation, where daily earnings (cents to dollars) cover essentials for those earning under $5/day.

Dependencies do arise of course: will the telco wish to establish semi-centralization. Surdak's risk rationality framework applies here—balancing decentralized trust with practical incentives to mitigate fraud or collusion. The Proof-of-Intent shifts blockchain economics from resource waste (Proof-of-Work) to efficient utilization, reducing environmental footprints while mitigating Proof-of-Stake's flaws like wealth concentration.

There is a marked difference in the number of subscribers each telco has and ReLeaf will work with the largest and smaller companies eg in Kenya - Safaricom, Airtel and Telkom Kenya and across Africa MTN Group and Vodacom. ReLeaf will also support the smaller ones seeking to gain competitive advantage over larger rivals. Thia is a mission and not a short-term growth journey.

In the remote hills of Ghana’s Volta Region, teacher Kwame once spent hours on a rattling tro tro bus just to download lesson plans in the city. His students, bright, curious and hungry to learn, lagged behind their urban peers simply because the internet stopped where the paved road ended. Then a Starlink dish appeared on the school roof. SpaceX’s low Earth orbit satellites began beaming high speed internet directly from the heavens, no fibre cables required. Suddenly, Kwame streamed YouTube tutorials. His class joined virtual exchanges with schools in Europe and Asia. Children who had never left their village began learning coding, robotics and digital design.

unknownx500

unknownx500