Andre Symes, Group CEO of Genasys, explained that "I've been vocal about my views that scarcity drives innovation. Africa shows this better than anywhere else. With less means, telcos and tech firms built mobile money, payments, micro-loans and insurance models that outpaced the more established approaches designed for high-margin environments.

Jean Pierre Mugenga explains how a new patented platform from ReLeaf Financial may augment this innovation and enable telcos to offer consumers and small businesses with no access to bank accounts the benefits of extra income and an enhanced payment system via their smartphones.

Telcos, particularly those in Sub-Saharan Africa, already offer mobile money eg M-PESA, to make and receive payments. Vodacom, Safaricom and MTN are pioneers. MTN in Nigeria already transacts over 50% of all Nigeria's GDP via M-PESA completely bypassing global and local banks.

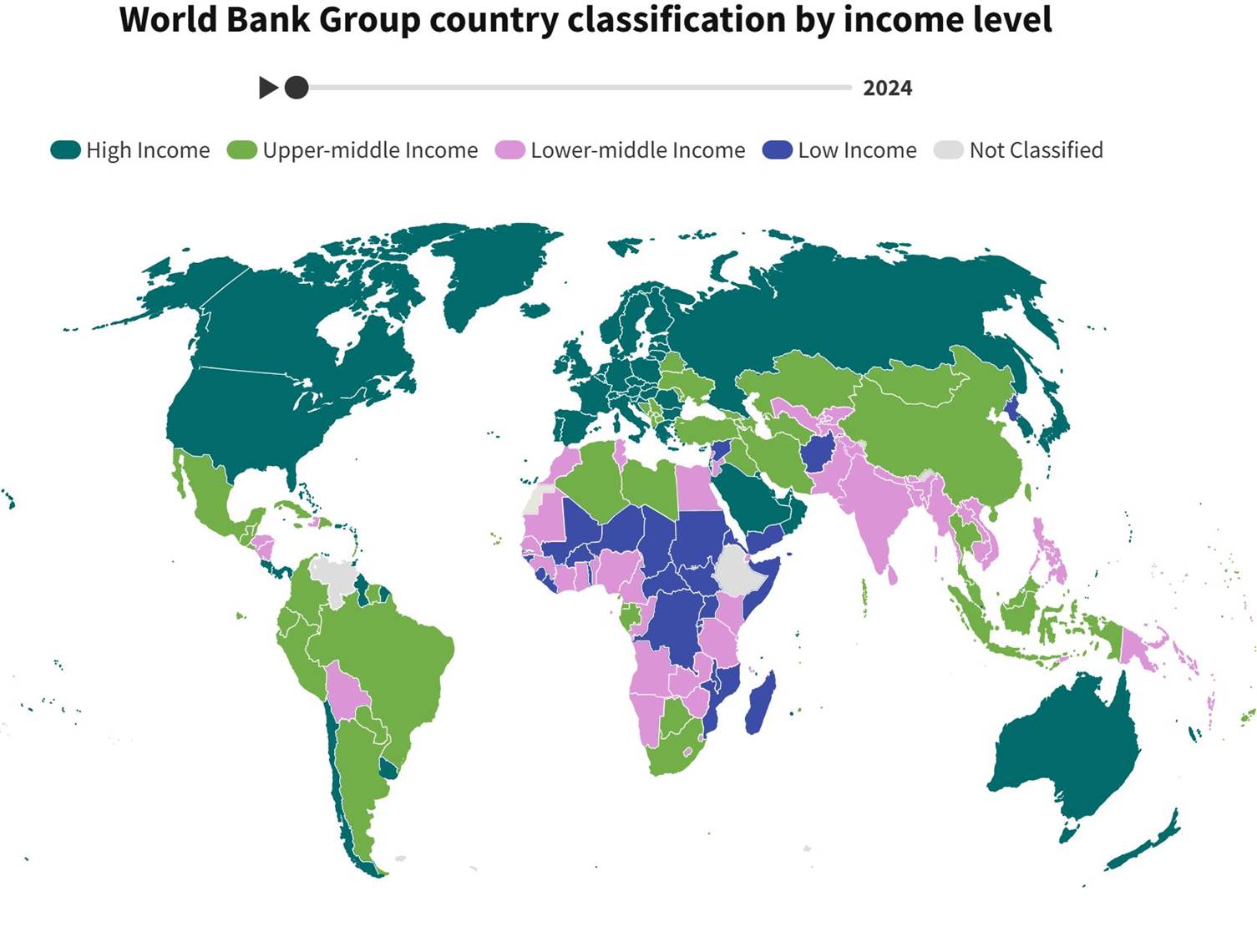

Sub-Saharan Africa, like LATAM and parts of Asia have both high- and low-income consumers and small businesses. The World Bank categorizes income distribution into 4 groups: -

- Low Income: $24 a week or less in 2024

- Lower middle-income economies are those with a GNI per capita between $25 and $94 a week

- Upper middle-income economies are those with a GNI per capita between $95 and $258

- High-income economies are those with more than a GNI per capita of $259 a week

$24 a week is just $5 a day; probably less as consumers often work 7 days a week lowering income to $3-$4 a day Imagine the difference that another $5 a day would make to these hard working people.

That is what Jean Pierre Mugenga describes in his article (follow link). A patented platform from ReLeaf Financial that can add £5 a day to low-income and middle-lower income consumers. What a difference telcos can offer by delivering extra income that makes lives easier and contributes to growth. And so much more effective than current loyalty programs that cost the earth and still suffer high churn rates.

ReLeaf’s core innovation, a patented-technology called "Proof of Intent" (POI), seeks to turn billions of smartphones into a decentralized workforce. This will add value for those parts of a telco’s financial ecosystem such as micro-loans, micro-contracting and micro insurance.

Unlike the energy-intensive "mining" associated with Bitcoin, POI is designed to be invisible. While a phone sits in a pocket or charges overnight, it lends a microscopic fraction of its processing power to validate blockchain transactions. It is a lightweight, randomized system where devices confirm the "intent" behind digital payments, securing a network without draining a battery or requiring a single tap from the user.

However, the road to digital equity is littered with the carcasses of "inclusive" tech projects. Critics point to previous mobile-mining apps that turned out to be malware, or the inherent volatility of the blockchain space. Questions remain about how governments in restrictive regulatory environments will view a decentralized validation network humming in the pockets of their citizens.

ReLeaf counters by leaning on Chaum’s legacy of privacy. The system is designed to be anonymous and data-light, integrated directly into existing carrier apps so that a user like Fatima doesn't have to learn a new language of private keys or digital wallets. Consumers and businesses that trust telcos delivering Mobile Money will trust this platform which would be embedded in the telco's backend using its security and compliance and mobile money payments system.

The model is a three-way handshake: the user gets a subsidized digital life; the telco sees a spike in Average Revenue Per User (ARPU) and a drop in churn; and ReLeaf sits in the middle as the toll-keeper for the infrastructure.

For telcos without mobile money apps ReLeaf will deliver a complete payment system with POI and identity validation. Two pilots start in LATAM in Q1 2026

Chris Surdak, the CEO of ReLeaf says "As the "Godfather of Crypto" and our Chief Technology Vision Officer David Chaum ha s recently said, "Proof of Intent is the breakthrough we always needed. This changes everything. Our platform technology allows smartphones and other devices to become self-funding, nano-crypto-mining rigs, bringing economic inclusion to billions of the world's disenfranchised. "

In Forbes Magazine, Douglas Laney says another 2 billion customers without access to banking are up for grabs and it looks like telcos have leapfrogged them. Laney says:

“The last quarter of humanity joining the digital economy won’t wait for JP Morgan Chase, Citibank, HSBC, or Deutsche Bank, or local banks to notice them. They’re building something new, using the phones already in their pockets. Some telcos and innovators will own this transformation, while others will spend years trying to catch up.”

2026 will be a transformative year and ReLeaf Financial's goal is at the heart of this.

Further Reading

Telcos Are Becoming Banks For The Next 2 Billion Customers- Forbes Magazine

Kenya’s Payments Evolution: What Banks and Fintechs Can Learn From M-Pesa and Mobile Operators

Orange Money: 9 billion transactions, €164 billion transferred by 2024 in Africa

In the humid, cacophonous sprawl of the Mushin Market, Fatima Adebayo conducts a daily symphony of survival. To the casual observer, she is a trader of dried peppers and groundnut oil. To the global economy, she is a data point in the "unbanked" billions. But to Fatima, the battered, second-hand Android phone tucked into her waist wrap is something more visceral: it is a lung.

unknownx500

unknownx500