Can Mobile Virtual Mobile (MVNO) Operators really threaten incumbent telcos with their established infrastructure and customer bases? In Africa,MNOs like Safaricom and MTN have added digital money payments and financial services for customers without banks.

In developed markets you should look at challenger banks Revolut and Monzo announcing MVNOs. Even BT in the UK has ambitions to leapfrog incumbent European telcos and has MVNO Giffgaff in its portfolio.

‘The UK Mobile Virtual Network Operator Market is projected to grow from USD 67.3 billion in 2025 to USD 122.6 billion by 2031, at a CAGR of 10.4% during the forecast period. Growth is driven by the rising demand for affordable telecom services, the expansion of IoT and enterprise connectivity solutions, and regulatory support that encourages competition in the telecom sector. MVNOs are well-positioned to capitalize on niche market opportunities while expanding service portfolios in UK’

Source: Mobility Foresights Feb 9th, 2026

MVNO-Fintech Developments

Between April and August 2025, Revolut, N26, Klarna, and Monzo — collectively serving over 100 million customers — launched or announced the launch of Mobile Virtual Network Operators (MVNOs) services. These weren’t coordinated moves, but rather represent independent recognition by the world’s most sophisticated fintechs that traditional growth economics have failed, and that MVNOs offer a sustainable path forward. The concentration of launches within five months signals a complete market inflection. The 18–24 month window for first-mover advantage is already narrowing.

Mike McLaren, investor, entrepreneur with a deep knowledge of Telcoms, Fintech and Banking markets has authored a compelling case, and well referenced & researched article, that a current thrust of convergence between Fintechs and MVNOs threatens traditional banks, incumbent telcos and indeed unambitious financial services companies.

It is the opportunity of 2BN unbanked customers who still need digital payment, micro-loan, micro-insurance and micro-contacting . Read the linked article for the full facts as the potential demands are attractive to say the least. And incumbent mobile network operators (MNOs) have proved the market potential with mobile money.

M-Pesa: The $1 Billion Market Validation

Kenya’s M-Pesa represents the definitive proof that mobile-financial integration creates massive value, generating over $1 billion annually — 42.4% of Safaricom’s service revenue — through a comprehensive financial platform processing over 33 billion transactions annually with 34 million active users (TechAfrica News, 2024; ITWeb Africa, 2025)

MTN Mobile Money: Continental Scale that Took 10 Years

MTN’s mobile money platform, MoMo, reached approximately 66 million active users by Q2, 2024, exemplifying telecom-based financial services achieving massive scale across more than 16 African markets and processing billions in transaction value annually.

Therein lies the rub. MNOs are complex, with much legacy technology and must be applauded for successfully changing the lives of even low-income famillies. But can they adapt quickly to MVNOs that can move faster to converge with Fintechs and Insurtechs? McLaren argues that it will take them 24 monghs or longer and in that period MVNOs can launch and deploy an array of mobile subscriptions, digital money payments, and associated insurance and financia lservices. Will the MNOs miss out on this new market worth $150BN?

Read the full article to make your judgement-

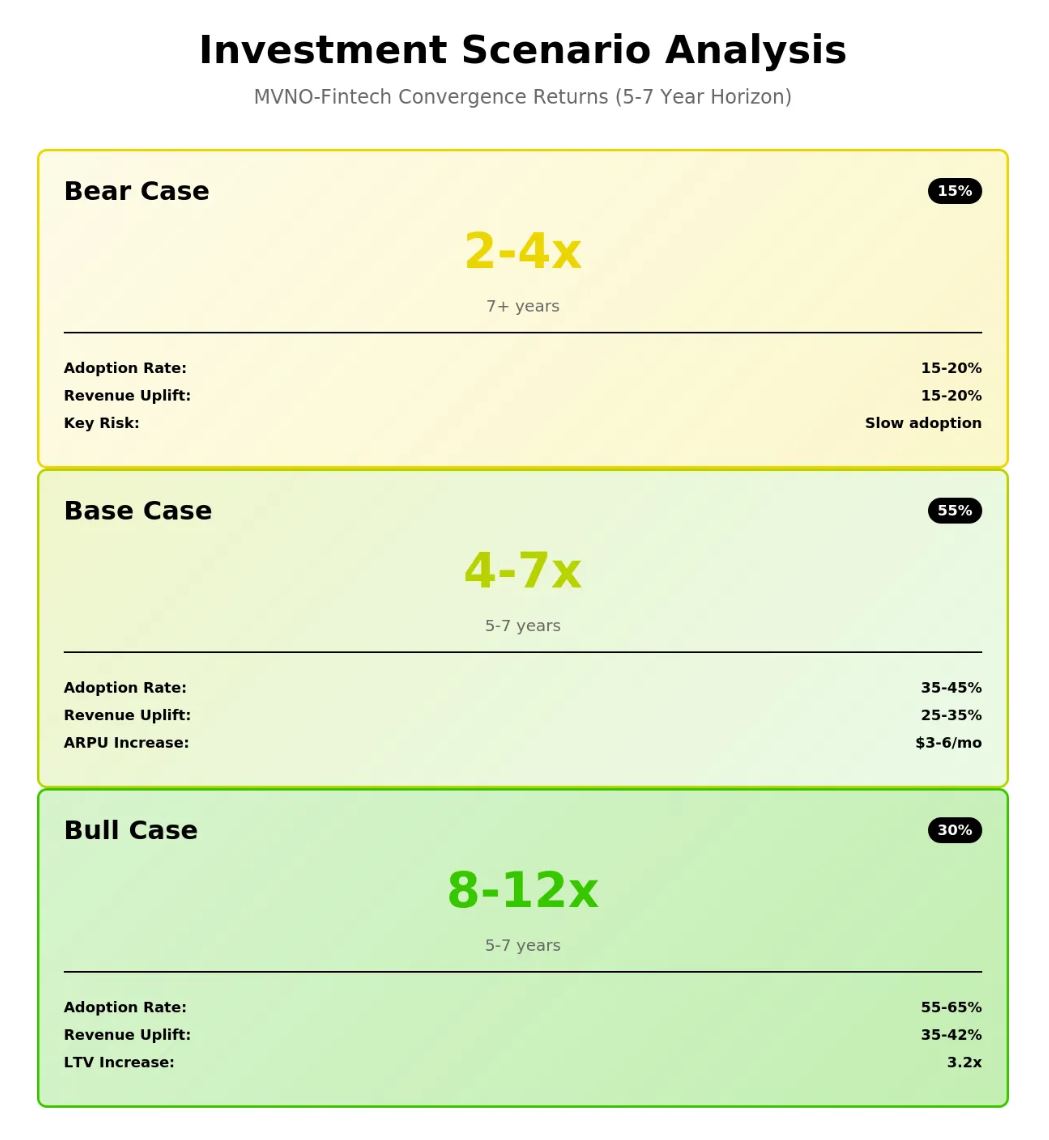

If you agree then the returns for MVNOs are outstanding.

Again look at the linked article that explains this business model.

The point I am making is that this is happening now, not in 6 months time. Monzo has a Head of Insurance and like Revolut delivers embedded insurance at point of sale. Embedded and parametric insurance are ideal for this distribution channel. These banks focus on developed high income countries but are expanding fast.

And in Africa where Mobile Money is an essential to so many people's lives?

African MVNO Success Stories

When South African challenger bank Capitec launched their MVNO in 2021, they weren’t launching a mobile service — they were completing a customer platform creating unsustainable competitive pressure on traditional operators.

The execution delivered extraordinary results: 1.6 million subscribers by 2024, representing the fastest MVNO growth in African history. Capitec demonstrated significantly higher cross-sell rates to banking products compared to traditional MVNO offerings, with substantially higher revenue per integrated customer due to comprehensive financial service usage. The integrated platform creates customer lifetime values meaningfully above standalone banking or telecom offerings.

Capitec’s execution demonstrates platform completion strategy rather than revenue diversification: the bank didn’t launch an MVNO to add a product line — it completed a comprehensive customer platform that makes switching to competitors prohibitively costly. Mobile services lock in banking customers while banking relationships reduce MVNO churn, creating a reinforcing cycle that standalone operators in either category cannot replicate. The compressed timeline proves particularly significant: from MVNO launch in 2021 to 1.6 million subscribers by 2024 represents faster growth than any traditional African MVNO achieved, demonstrating that fintech-first approaches can outperform telecom-first approaches in the convergence race. This South African case study provided the blueprint that European fintechs adapted for their Q2 and Q3, 2025 launches.

Most importantly, Capitec achieved these results with CAC significantly below both fintech industry averages and traditional MVNO acquisition costs.

JamboPay’s unique market position as both a leading fintech provider and licensed MVNO in Kenya demonstrates convergence viability from the MVNO perspective. According to company reported figures, with 1.2 million customers across their integrated platform, the company proves that focused operators can successfully compete with both banks and major telecoms.

Unlike Safaricom’s decade-long M-Pesa development process, JamboPay achieved integration within 18 months by leveraging existing fintech expertise and MVNO agility. The company’s CEO noted that traditional MVNOs are “leaving at least 42% of revenue on the table” by not integrating financial services.

Rain’s transformation from data-focused operator to South Africa’s fourth major mobile network demonstrates platform-first thinking enabling rapid service expansion that larger operators struggle to match.

Rain began building its network in 2016 with cloud-native, standalone infrastructure designed for service integration. The company’s platform approach allowed evolution to full mobile services through its rainOne integrated platform launched in May 2023 — a development cycle that would have taken major MNOs 3–5 years.

Rain’s strategic backing reinforces the telecom-fintech convergence thesis. The company secured investment from African Rainbow Capital, with former FNB CEO Michael Jordaan serving as director and shareholder. This financial services expertise demonstrates how convergence attracts investment from established financial sector leaders who recognize MVNO agility advantages.

Insurers should factor these trends into srategic plannimng especially as distribution changes and emeging business models continue to advance e.g.

Embedded insurance

Parametric Insurance

Afinity Insurance

Micro Insurance

Whether you are a MNO, an insurer, a bank, a payment rail - you had better factor this transformational trend into your strategies. Before it is too late.

Final Word

Incumbent MNOs have a large user base of course so they have a momentum. The article argues that they will find it challenging to win the next 2 billion customers unles they can transform more quickly.One way,of course, would be to acquire MVNOs just like BT has. That has the danger of eroding the MNO's user base but as customer churn is high is that a real threat? In the meantime they could protect their current user base by transforming expensive loyalty programs that have not stopped high churn rates.

ReLeaf Financial has already developed a Proof of Intent #POI platform that can be integrated into the backend systems of MNOs and leverages the latent compute power of subscribers' smartphones opening up new income streams for them and the telco.That makes all current loyalty programes obsolete and can help protect the large current user bases of Safaricom, MTN, Vodacom ad other incumbent MNOs.

The fly in the ointment is that MVNOs can adopt the same platform to win and keep new customers and are more likely to do so faster than incumbent MNOs with a ‘let’s wait and see' culture. If they wait 6 months even, hat only leaves them 12 to 18 months to transform.

Interesting times indeed.

References

The $150B Blind Spot: Why MVNOs Will Win the Next Fintech Revolution

Reimagining Telcos based on Altair Research

Telcos Are Becoming Banks For The Next 2 Billion Customers Forbes Magazine

UK Mobile Virtual Network Operator Market Size, Share, Trends and Forecasts to 2031 Mobility Foresights

When Poverty Meets Innovation: Five Technologies Rewriting the Rules of Survival Culture & Clarity

The Market Has Spoken: The Developments in Q2 and Q3, 2025 Between April and August 2025, Revolut, N26, Klarna, and Monzo — collectively serving over 100 million customers — launched or announced the launch of Mobile Virtual Network Operators (MVNOs) services. These weren’t coordinated moves, but rather represent independent recognition by the world’s most sophisticated fintechs that traditional growth economics have failed, and that MVNOs offer a sustainable path forward. The concentration of launches within five months signals a complete market inflection. The 18–24 month window for first-mover advantage is already narrowing.

unknownx500

unknownx500