Andre Symes, Group CEO of Genasys, explained that "I've been vocal about my views that scarcity drives innovation. Africa shows this better than anywhere else. With less means, telcos and tech firms built mobile money, payments, micro-loans and insurance models that outpaced the more established approaches designed for high-margin environments.

I’ve also long argued that insurers should look to telcos rather than banks for inspiration. Telcos had to innovate in product design, pricing and distribution in ways insurers now must. Banks never had to hustle like that".

"Every matatu ( the bus in the photo image) I boarded had a number displayed, either a Safaricom phone number, till, Paybill, or pochi la biashara number. And it wasn’t just stuck there for show. People were actually paying through it. No arguments, no awkward stares, no fumbling for coins. And the best part? Even the conductors were cool with it.

Now don’t get me wrong. You can still pay with cash. It’s not outlawed. But more and more people are opting for mobile payments, and you can feel the shift happening in real time."

Hillary Keverenge in linked article July 2025

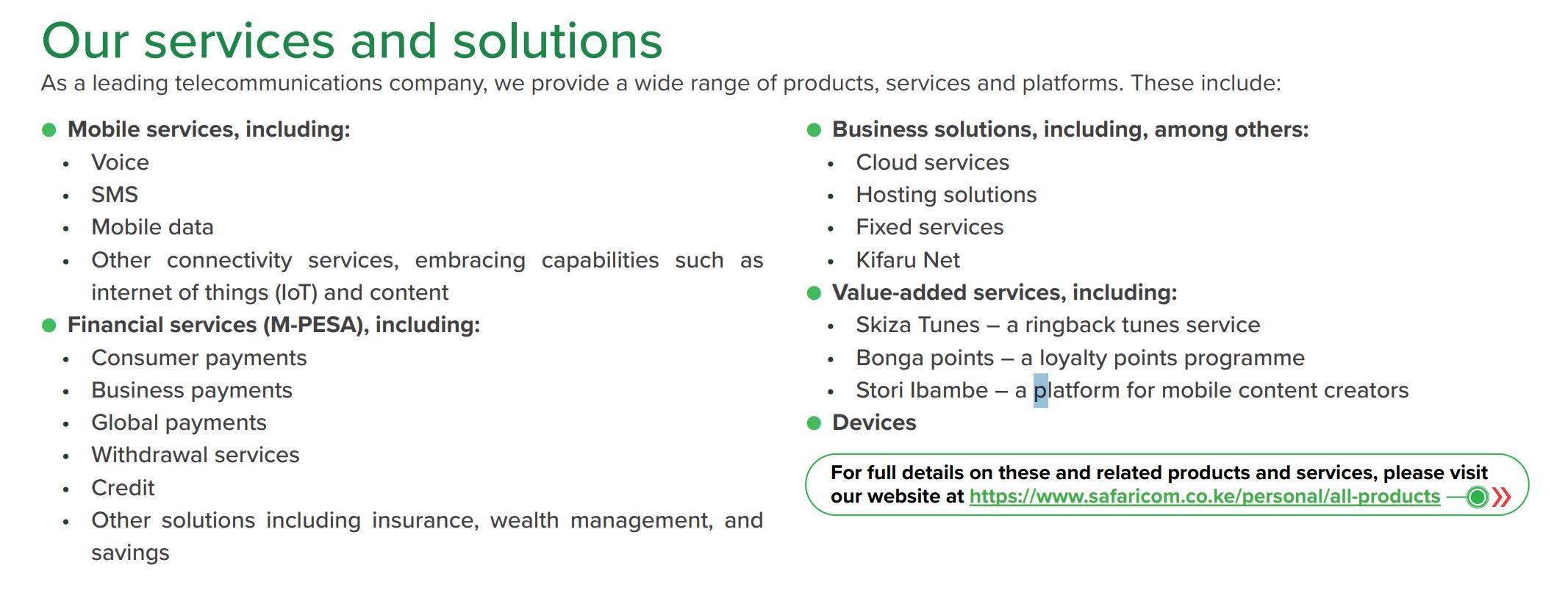

Telco Safaricom and its wholly owned subsidiary M-PESA have already empowered digital payments for Kenya and similar ventures can be experienced across aross Nigeria, Rwanda and other African nations. They are national financial services ecosystems as can be seen below.

Payments and monet receipts are offered between consumers and businesses across the nation togther with a range of financial services including insurance.

In Ghana, MSN offers similar services and global giant Orange spans 26 countries and with Orange Money targets African markets.

Cross-border payments are offered via a network of agents and partners and are naturally more complex. Is Google's AP2 platform the answer or is it just a ‘Western high income nation payments platform’?

Google’s announcement of its Agent Payments Protocol raised great interest last week. In partnership with 60 organisations, banks, payment providers and merchants including American Express, PayPal, Revolut, Salesforce, and WorldPay.

AP2 (Agent Payments Protocol) is an open, interoperable protocol built on top of existing agent standards like A2A (Agent-to-Agent) and MCP (Model Context Protocol). It provides a “payment-agnostic framework” for secure, agent-led commerce, supporting multiple payment types including cards, stablecoins, and real-time bank transfers.

Google has aimed this eCommerce protocol at the market for agents, or digital workers and at regions where the infrastructure is well developed and aims to deliver: -

- Enhanced trust

- Reduced fraud and disputes

- Interoperability across multiple vendors

- Support for agent led transactions as well as human oversight.

- Innovation platform for user experiences across networks

Nevertheless, time will be required to address key challenges including: -

- Regulation and legal recognition across countries with different compliance rules

- Security and privacy concerns- agents and digital workers are currently mainly appropriate for simple, high volume, well understood processes

- LLM hallucination, drift and lack of contextual understanding

- User experience- managing wallets today is not a simple UI

- Merchant and payment integration investment costs

- Crypto and stablecoin adoption lead times

Google may expect to tackle these in the developed nations of North America, Europe and parts of Asia. Customers, banks, payment providers and merchants are already used to paying high transaction costs. But what about low-income and middle-income nations?

Consumers with an income of $5 to $15 a day will not pay $0.50 a transaction- they do not with mobile money payment. Nor matatu, truck and van operators operating on very slim margins and unpredictable cashflow.

These markets completely skipped traditional banking evolution. The World Bank's Global Findex Database shows 1.4 billion adults remain unbanked, concentrated in regions where mobile money already dominates. Rural Colombia never built bank branches. Nigerian villages never installed ATMs. When mobile payments arrived, people switched from cash directly to digital money without the friction of changing established habits.

Telcos are already in a strong position.

"The mobile industry has never been more important to the world's citizens and economy," says Mats Granryd, Director General of GSMA. "Mobile money is a game-changer for the financial inclusion of women and other underserved groups. It provides a gateway to a wider range of financial services, including savings, credit, and insurance, which can help people build resilience and improve their livelihoods."

When will there be an equivalent platform to Google’s AP2 that is viable for Africa consisting of 54 different countries, each with its own regulatory environment, its own currency, its own challenges, and its own opportunities? You can't have a one-size-fits-all approach.

With Telco’s success as mobile payment providers in these regions, such a platform could extend their services and revenue opportunities as long as it can work on smartphones, current infrastructure and with compelling apps and user interfaces.

Telcos in Latin America and Africa continue to build something new, using the phones already in their customers’ pockets. Some telcos and innovators will own this transformation while others will spend years trying to catch up.

Matatus in Nairobi and beyond have fully embraced M-PESA as the primary mode of fare payment. Unlike failed attempts like BebaPay and My1963, this shift is organic, with passengers and conductors equally onboard. No more coins, no more fuss. Just a phone, a number, and a buzz confirming your ride is paid.

unknownx500

unknownx500