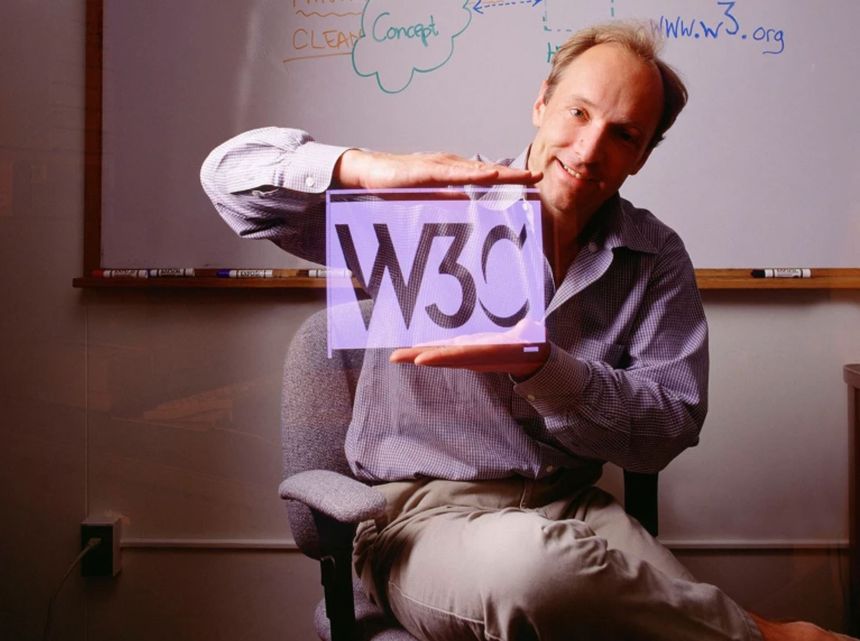

Tim Berners-Lee, generally credited as founder of the Word-Wide Web (WWW) is disolutioned with the exploitation of the WWW by tech giants and the current wave of LLM vendors like OpenAI that promote a flawed technology whilst demanding ever increased funding from suppliers, governments and investors. Funding that they will arguably never be able to pay back as most users are individuals, who pay small subscription fees, and organisations are only using GenAI, LLMs and AgenticAI for certain basic tasks i.e.

- Boring and mundane

- High volume and repetitive

- Well understood processes

- Like trawling insurance policy documents and other unstructured data to check and validate cover for claims

David Chaum, a cryptographer and inventor, founded DigiCash, created eCash, and published the first examples of blockchain technology. His breakthroughs in privacy and cryptography have shaped today’s landscape of digital currency and secure transactions. He is critical of the extractive business models of today's payment rails vendors, banks and large monopolistic tech giants like Google. Western vendors have grown used to fat margins and customers of paying them.

Chaum’s 1982 paper “Blind Signatures for Untraceable Payments” was the first to outline a practical system for digital currency. It laid the cryptographic foundation for anonymous payments — the seed of what would eventually grow into Bitcoin and beyond.

He has joined as co-founder of Releaf Financial which he passionately believes delivers on the original objectives and technology he promoted

Both Chaum and Berners-Lee hoped their initiatives would evolve into inclusive services for the good of humanity rather than explotative business models driving higher priciing and profit margins.

Releaf Financial has taken that objective as the core of its mission. After seven years development and overcoming the challenge of patenting the technology, Chris Surdak the CEO and his team has launched a blockchain, cryptocurrency and proof of intent platform aimed to deliver benefits to low and middle income countries in LATAM and Sub-Saharan Africa (SSA) where large numbers of the population earn just $5 to$25 a day. They cannot afford the digital payment services from western vendors. But say they could gain extra income as they manage their daily lives?

SSA telcos in countries with goverments supporting a firm compliance and regulatory framwork have delivered mobile money for subscribers without bank accounts.

- Vodacom Group drives Africa's fintech revolution via digital services, with 18.1% YoY financial revenue growth in Q1 2025.

- Its platforms process $460B in mobile money annually, expanding financial inclusion through M-Pesa, Vodafone Cash, and VodaPay.

- Strategic 8-country expansion targets 120M financial users by 2030, leveraging network effects and product diversification.

By Julian West AInvest July 23rd, 2025

Andre Symes, Group CEO of Genasys, explained that "I've been vocal about my views that scarcity drives innovation. Africa shows this better than anywhere else. With less means, telcos and tech firms built mobile money, payments, micro-loans and insurance models that outpaced the more established approaches designed for high-margin environments.

I’ve also long argued that insurers should look to telcos rather than banks for inspiration. Telcos had to innovate in product design, pricing and distribution in ways insurers now must. Banks never had to hustle like that".

Releaf Financial is partnering with telcos in LATAM and SSA to integate proof of intent (POI) , payment validation and digital payments with the mobile money solutions already trusted and used by subscribers. ReLeaf therefore leverages the security, compliance and ecosysem benefits of the telco.

Every matatu ( the buss in the photo image) I boarded had a number displayed, either a Safaricom phone number, till, Paybill, or pochi la biashara number. And it wasn’t just stuck there for show. People were actually paying through it. No arguments, no awkward stares, no fumbling for coins. And the best part? Even the conductors were cool with it.

Now don’t get me wrong. You can still pay with cash. It’s not outlawed. But more and more people are opting for mobile payments, and you can feel the shift happening in real time."

Hillary Keverenge in linked article July 2025

From Payphones to Phones that Pay

Most people haven’t considered the possibility of earning money while their smartphones sit idle. However, ReLeaf developed a patent-pending system called "Proof of Intent" that turns phones into transaction validators. When someone in Peru sends money to their family, phones in Colombia could verify the transaction. Phone owners can earn small cryptocurrency rewards that add up to cover data plans, airtime, or groceries—thereby potentially solving the loyalty and retention problem.

"There are billions of people living on three or four dollars a day if they're lucky," Surdak explains. "How can you meaningfully exist today without being digitally connected? ReLeaf makes both happen at the same time."

Claro, a major Latin American telecom, calculated that there is over $350 million in potential new revenue out there over the next five years, with significantly lower churn. This doesn’t even require any new infrastructure, just software updates to existing apps.

Dante Disparte, Chief Strategy Officer at Circle, sees broader implications: "In many parts of the world, having access to a stable currency is not a given. Stablecoins can provide a safe and reliable store of value for people in countries with high inflation or political instability." He adds that stablecoins are programmable, which "opens up a whole new world of possibilities for financial services in emerging markets, from micropayments and remittances to decentralized finance applications."

Tens of millions of telco subscibers have pre-signed for the 2026 production release. Meanwhile ReLeaf is partnering with telcos to integrate into their own payments apps.

ReLeaf Is fully aware of three key hurdles to overcome: -

1) Tangible economic value must be proven (can I spend this today?),

2) simplicity of use

3) trust.

How?

Every subscriber can see today's current value of the cryptocurrency and convert into local currency at any time

Integrating into the backend of the telco and levaraging its security, compliance and ecosystem means ReLeaf runs as a passive app in the background. Simplicity itself

The telcos have already built a trusted ecosystem and ReLeaf sits within that

Traditional banks in New York or London can't pull this off. They face centuries of regulations, customers expecting physical branches, and systems held together with outdated COBOL code. Emerging markets don't have that baggage.

In Kenya, M-PESA proved it. One telecom company, using basic phones and zero banking infrastructure, now processes half of Kenya's GDP. The GSMA's 2024 Mobile Money report reveals that global mobile money transactions exceeded $1 trillion, with Africa accounting for 70% of that volume.

Elizabeth Rossiello, CEO of AZA Finance, stresses the need for local solutions: "Africa is not a country. It's a continent of 54 different countries, each with its own regulatory environment, its own currency, its own challenges, and its own opportunities. You can't have a one-size-fits-all approach."

She's watched the transformation firsthand: "The future of payments in Africa is mobile. We've seen a huge leapfrog effect, where many people have skipped the traditional banking system and gone straight to mobile money. This has created a massive opportunity for innovation in the digital payments space."

ReLeaf offers a win:win technology platform for subscribers, telcos and ecosysem parthers.

Subscibers

Subsidize costs of devices, data plans

Earn real-world value: convert into local currency

Simple, passive income- the telco and ReLeaf deploy the service

Telcos

Replace marketing/loyalty program costs with profit generation

Reduce customer churn significantly

Increase annual and lifetime revenue per customer without raising prices

Ecosystem Partners by supporting

Micro-contracting

Micro-payments

Micro-loans

Embedded micro-insurance

Telcos have already leafrogged banks in LATAM and SSA. ReLeaf will add Asia later. Telcos are already targetting the next 2 Billion unbanked users and ReLeaf is a catalyst and partner for that transformation

Berners-Lee’s central argument is that the web has strayed from its founding principles and been corrupted by profit-driven companies that seek to monetize our attention. But it’s still possible to “fix the internet”, he argues, outlining a utopian vision for how that might be done. In it, social media would be designed to “maximize the joy” the user experiences instead of fuelling division, and technical standards would be introduced to prevent the mistakes of the social-media era from being repeated in the age of artificial intelligence. Both ideas are optimistic — some might say naive — but coming from someone so integral to the web’s creation, they carry particular weight.

unknownx500

unknownx500